Budget FY24: The proof is in the pudding

[ad_1]

[ad_1]

Finance Minister Ishaq Dar rolled out the numbers for budget 2023-24 in the National Assembly with a cold conviction, as if torn between the International Monetary Fund (IMF) diktats and the hopes of a people pauperised by runaway inflation.

While some analysts initially labelled the budget as a reasonable attempt given the constraints on Pakistan’s economy, detractors quickly entered the fray by launching a succession of broadsides against the finance minister.

Some criticism directed against the finance minister was partially caused by Dar’s post-budget statement about Pakistan seeking to reprofile or reschedule its bilateral debt.

All this commotion, however, has left the common people confused about how to evaluate the performance of the coalition government, in general, and that of Dar, in particular.

To develop a better purchase of this budget, there is a need to properly contextualise this policy document by identifying the political and economic pressures on Pakistan’s economy.

While many economists believe that the global economic downturn and 40-year-high inflation are responsible for Pakistan’s present economic woes, this coalition government also seems to have made some policy decisions in haste. For instance, changing finance horses in midstream could have been avoided, given Pakistan was engaged in tough negotiations with the IMF.

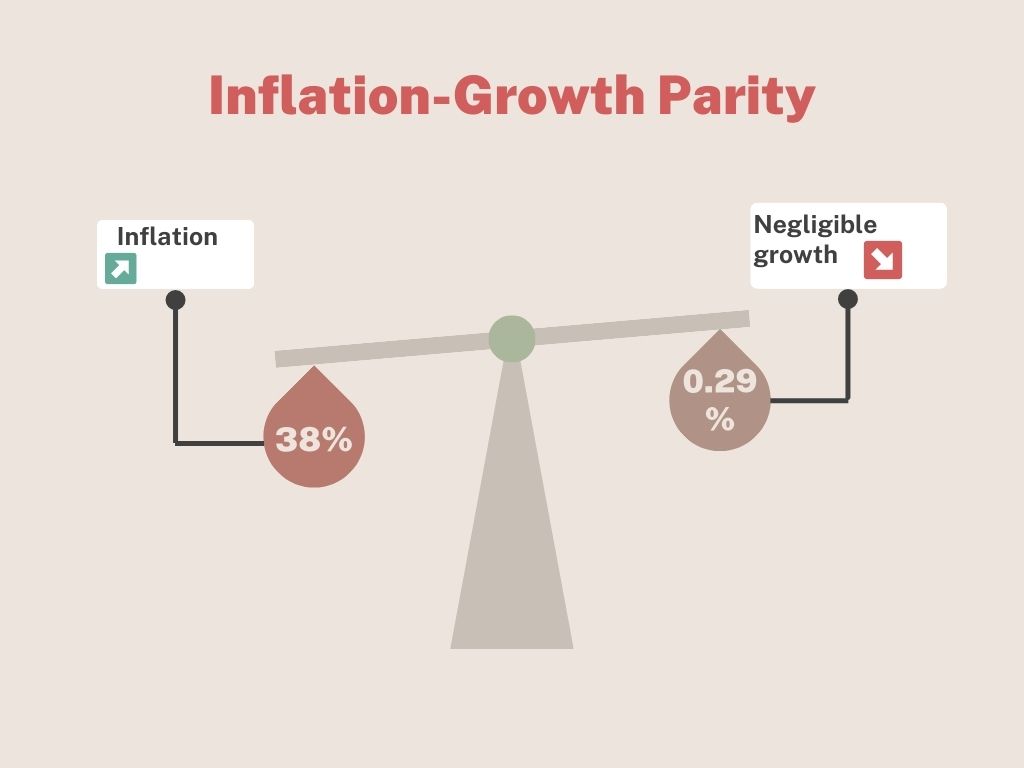

Assuming this will be an election year, this coalition government is under tremendous political pressure owing to the ongoing stagflation — negligible growth at 0.29% and record-high inflation at 38%.

Given such high levels of economic misery, the government would have done its utmost to provide a “populist” budget as it would have won the government more political support. Usually, populist budgets involve fiscal spending, thereby increasing the fiscal deficit.

Even though the government may have wanted to go on a spending spree, its hands were largely tied due to the conditions laid down by the IMF regarding the fiscal deficit.

As a result, where the budget is being branded populist, it is actually reducing the fiscal deficit by almost 1.5% of GDP over the last two years. And, where analysts are rightly concerned about the huge amount of debt-related interest payments in the next three years, the government is actually covering its operational expenses by generating a primary surplus — surplus before making debt-related interest payments.

Given the political and economic constraints, this budget appears to be a reasonable attempt at narrowing the twin deficits

Where the full implications of the present budget will become clearer with time, there are some bright spots in the budget. For instance, the allocation of the BISP has been increased to Rs450 billion with the promise of matching stipends — currently at Rs3,000 per family per month — to inflation.

The importance of enhancing social safety programmes like BISP or increasing the minimum wage cannot be stressed more, given that stagflation has pushed almost two million additional Pakistanis below the poverty line.

The substantial increase in the federal Public Sector Development Programme (PSDP) from Rs567 billion to Rs1,150 also holds promise, provided this amount is utilised efficiently and transparently.

This is for the simple reason that PSDP remains the mainstay intervention for bringing about GDP growth and job creation. PSDP’s special focus on youth welfare is also a welcome development, given that Pakistan is a very young country with a median age below 23 years.

Nonetheless, this budget has been criticised for giving an exorbitant increment to public-sector employees and not sharing tangible plans for privatising State-owned Enterprises (SOEs). The criticism of providing a substantial increase may be partially justified as this increment could have been spread over two years, but criticism for not providing privatisation plans is not.

It should not be forgotten that SOEs’ privatisation is a major undertaking that a government with a weak mandate is not going to attempt, especially in an election year when one of its key allies has been opposed to privatisation, at least in the past.

All in all, given the political and economic constraints, this budget appears to be a reasonable attempt at narrowing the twin deficits — fiscal and external — that plague this economy.

It is unclear why Dar has come under criticism as pre-emptive debt reprofiling for Pakistan was also recommended in a recently-concluded conference on debt sustainability at Boston University.

Debt reprofiling is usually done to assist with foreign exchange liquidity by extending maturity and increasing interest rates so as to preserve the Net Present Value.

Even though Prime Minister Shehbaz Sharif has sounded increasingly confident with respect to successfully concluding the ninth review with the IMF, detractors are still not buying it.

Perhaps, the only way to evaluate the merits of the present budget is to wait until the end of June to see whether Pakistan and the IMF sign on the dotted line. The proof of the pudding is in the eating, as they say.

The writer completed his doctorate in economics on a Fulbright scholarship. [email protected] He tweets @AqdasAfzal

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

Comments

Post a Comment