Land of flickering lights: Why Pakistan's power woes persist | The Express Tribune

[ad_1]

[ad_1]

PUBLISHED August 06, 2023

ISLAMABAD:Riaz lives in a one-room quarter in south Punjab. He is a farmer with a few acres of land and he waits for earnings every six months.

He has one ceiling fan alone to endure the scorching summer heat. Yet, he received a bill of Rs 8,000 for one month, he told Express Tribune; 8,000 for living in just one small room.

Around 43 percent of Riaz's total bill was charged as taxes and surcharges. He was paying debt surcharges, financial cost surcharges, federal excise duty, income tax, TV fee and an obscure fee was included under 'other tax' which he never knew about it.

The power sector is one of those sectors where owners of power plants continue to flourish while the consumers are buried under the weight of paying dues worth billions of rupees on account of hiking power tariffs. The average national tariff has gone up to around Rs 30 per unit excluding taxes and the impact of fuel price adjustment. The impact of taxes and fuel price adjustment will be 25 percent over and above the national average power tariff.

This hike in price per unit is more bad news for everyone — especially consumers like Riaz — who already struggle to afford electricity. Furthermore, the capacity payments also add to the consumers' miseries. This means that legal consumers paying regular bills are paying for idle power plants which do not operate but continue milking money from the consumers unbeknownst to them.

What is the problem?

Several issues have contributed to a lower power supply to the consumers.

Firstly, the subsidies that are involved in the power sector and the government has to announce subsidies for the power consumers in the new budget. The subsidy volume is based on the units supplied to the power consumers. So, the units are also budgeted every year to keep the subsidy volume within the limit. Therefore, the government avoids producing more units that could enhance the subsidy volume for the specific year.

There are some other factors as well.

Design: Mohsin Alam

Design: Mohsin Alam

Increase in installed capacity

Since the Musharraf regime, all subsequent governments have focussed working on thermal power plants while ignoring the hydel power plants which are the real asset for the country. Hydel power plants not only produce power but also work as reservoirs to store water for irrigation. The major dams of Tarbela and Mangla were built during tenure of the Ayub Khan (1958 to 1969). Since then, no major dam has been completed.

In 2007-08, Pakistan's power generation installed capacity stood at 19,566 MW. In 2023, it has reportedly crossed 41,000 MW. Despite that, the miseries in the power sector continue in form of load shedding, tripping and higher electricity cost. With the increase of installed capacity, the circular debt had gone up and the cost of electricity has also gone up from Rs 12 per unit to Rs around Rs 30 per unit in 2023.

Several reasons led to higher electricity costs for power consumers.

Poor energy mix

The first reason for the higher electricity cost is the poor energy mix. No government has succeeded to bring efficiency to the power sector or increase the generation capacity of hydel and renewable energy power plants. At present, the share of hydel power in the total energy mix amounts to 30 percent, according to figures presented to Nepra for the month of May 2023.

During the period under review, the share of coal was 17.7 percent, RFO 5.43 percent, indigenous gas 5.4 percent, RLNG 18.55 percent, nuclear 13.5 percent, wind 4.3 percent and solar 0.7 percent.

Imported fuel continues to dominate the power sector. The share of indigenous gas-based power plants is lower compared to power plants using RLNG, a type of fuel that was added to the power sector in 2015 when the PML-N government came into power. But this was imported fuel and had also become a rare commodity as the government had not been able to secure LNG contracts over the last two years due to its shortage and higher prices in the wake of the Ukraine war.

During the entire episode, the government does not seem to boost electricity from local resources. The PML-N government had made it possible to exploit Thar coal and power plants were installed. Now, Thar coal-based power plants can produce 2,400 MW. But there have been constraints in laying transmission lines and the NTDC had not been able to transport more than 1,400 MW of electricity.

The total electricity generation capacity during July-April 2022 has increased by 11.5 percent and it reached 41,557 MW from 37261 MW during the same period last fiscal year. The percentage share of hydel power in the total installed fuel-wise capacity has marginally reduced to 24.7 percent during July-April FY2022 as compared to its share in FY2021. The contribution of RLNG in the installed capacity has increased to 23.8 percent in July-April 2022 from 19.66 percent. The percentage share of coal remained the same, although there is an increase in the installed MW from 4,770 MW during July-April 2021 to 5,332 during July-April 2022.

The percentage contribution of gas has declined from 12.15 percent during July-April 2021 to 8.5 percent in July-April 2022.

There is an increase in the percentage share of renewable energy which is a good sign for the economy as well as for the environment. The percentage contribution of nuclear power has increased to 8.8 percent during July-April FY2022 from 6.68 percent during July-April FY2021.

The share of wind power has increased from 3.31 percent to 4.8 percent while the percentage share of solar power has increased from 1.07 percent in July-April FY2021 to 1.4 percent during July-April FY2022.

Design: Mohsin Alam

Design: Mohsin Alam

Poor investment in infrastructure

The government had not been able to maintain a balance in investment in infrastructure. By prioritizing setting up thermal-based power plants the Pakistani government ignored focussing on investing in distribution and transmission lines. Although, the country had an installed generation capacity of 41,000 MW, the system was unable to transmit the electricity more than 26,000 MW.

Recently, NTDC had submitted claims to Nepra to allow liquidity damages to pay to power plants due to failure to transmit committed electricity of 2,400 MW from Thar coal-based power plants. It was claiming Rs 80 billion to recover from the power consumers. However, Nepra had shown reluctance to pass on to the consumers.

High capacity payments

The present government had increased the average tariff from Rs 16 to around Rs 30 per unit during its tenure. The major portion was claimed by power producers on account of capacity payments.

This means that power plants were able to generate electricity but the system was not ready to pick. So, the government had to pay capacity payments to the power producers.

Faulty agreements with power producers

The governments had inked faulty agreements with power producers. Interestingly, the current government blamed the previous government for faulty agreements with power producers. The PTI government had blamed PML-N government for faulty agreements with power producers.

Circular Debt

Between 2005 and 2010, the cost of generation in the country increased by 148% and the average tariff by 33% on account of increased international oil prices, a higher share of furnace oil in electricity generation and the rupee depreciation. The circular debt started to emerge in the late 2000s. Successive governments relied on heavy budgetary support and quasi-fiscal financing to eliminate it. However, the measures addressed the symptoms and not the root causes.

The cumulative budgetary support to the power sector amounted to Rs 3,202 billion from FY2007 to FY2019. An amount of Rs 2,860 billion was paid on account of budgetary subsidies and Rs 342 billion as a liquidity injection. Yet, the circular debt stock has continued to grow and increased by Rs 465 billion in FY2019 to around Rs 1,600 billion leading to total financial loss to the country of Rs 4,802 billion over the 13 years.

It caused an annual loss of around Rs 370 billion due to inefficiencies in the power sector. This is especially alarming because, with public indebtedness (public debt/GDP) having increased to 85% in FY2019 from 52% in FY2007 the movement's ability to provide fiscal support to the sector is now severely constrained.

Back in 2018, the share of capacity charges in generation costs was around one-third, but today it has doubled to two-thirds for two main reasons namely due to new generation capacity added in the past few years and the net hydel profits being paid to KP and Punjab by Wapda, a decision taken in 2017 by the Council of Common Interests.

Design: Mohsin Alam

Design: Mohsin Alam

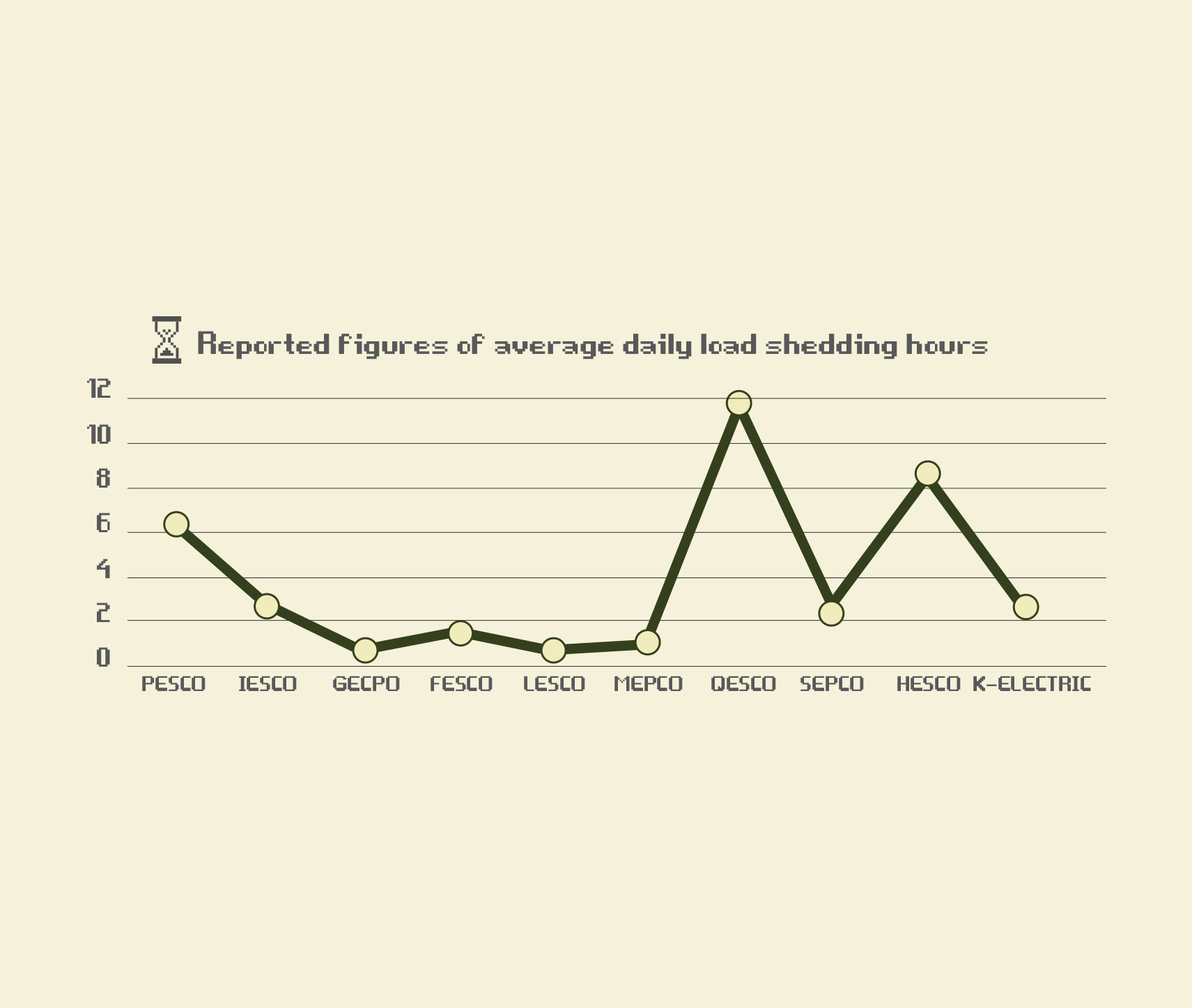

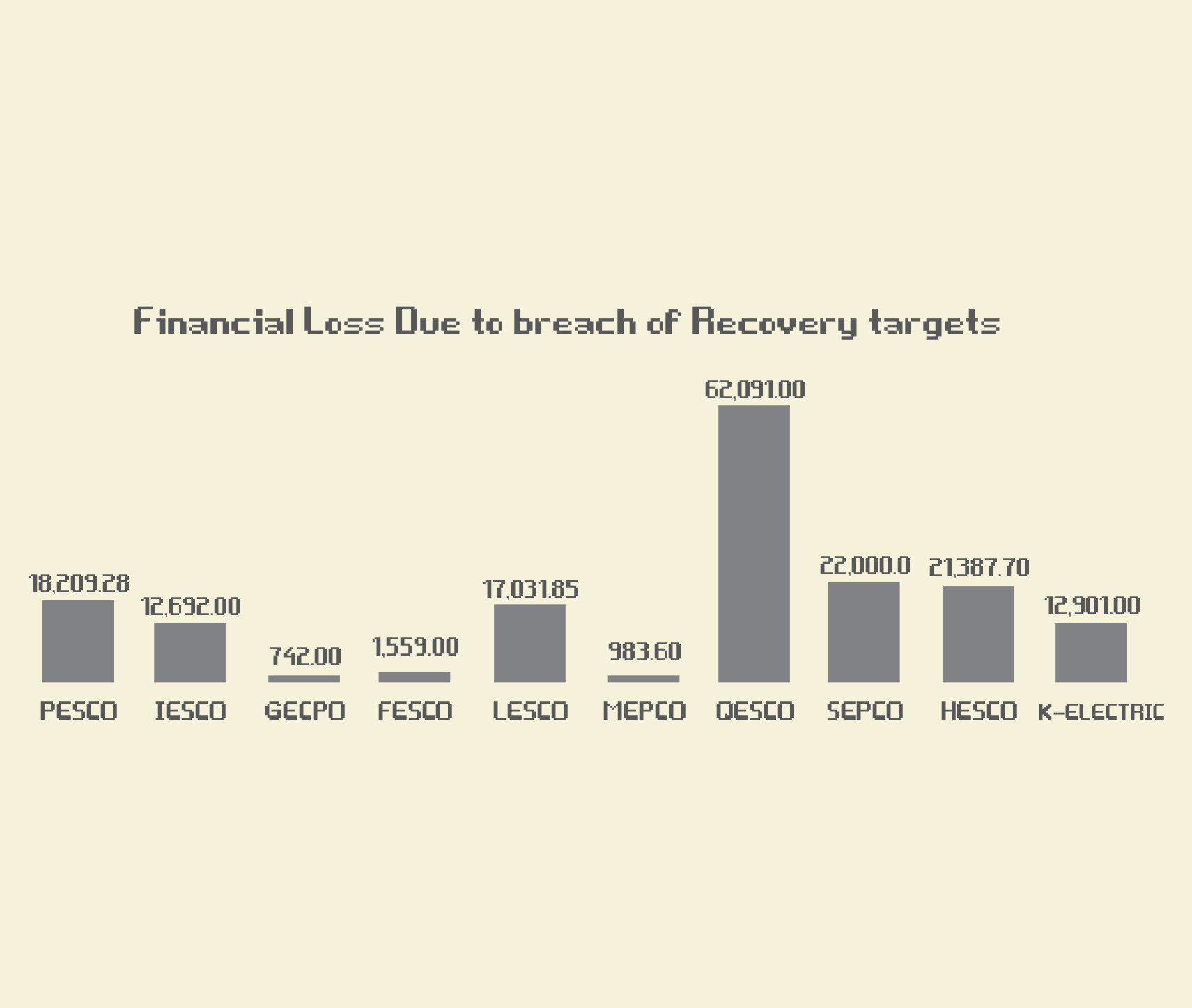

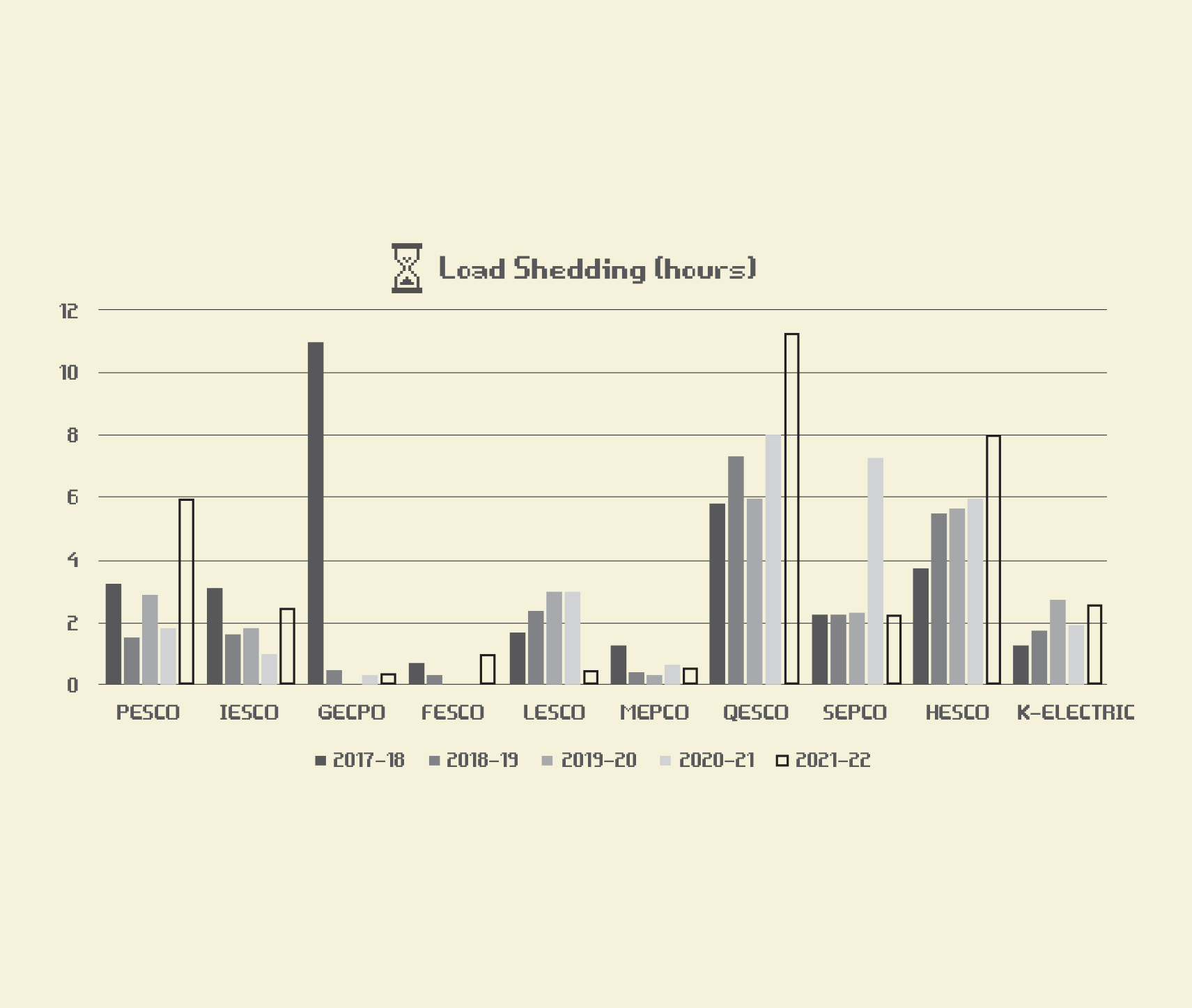

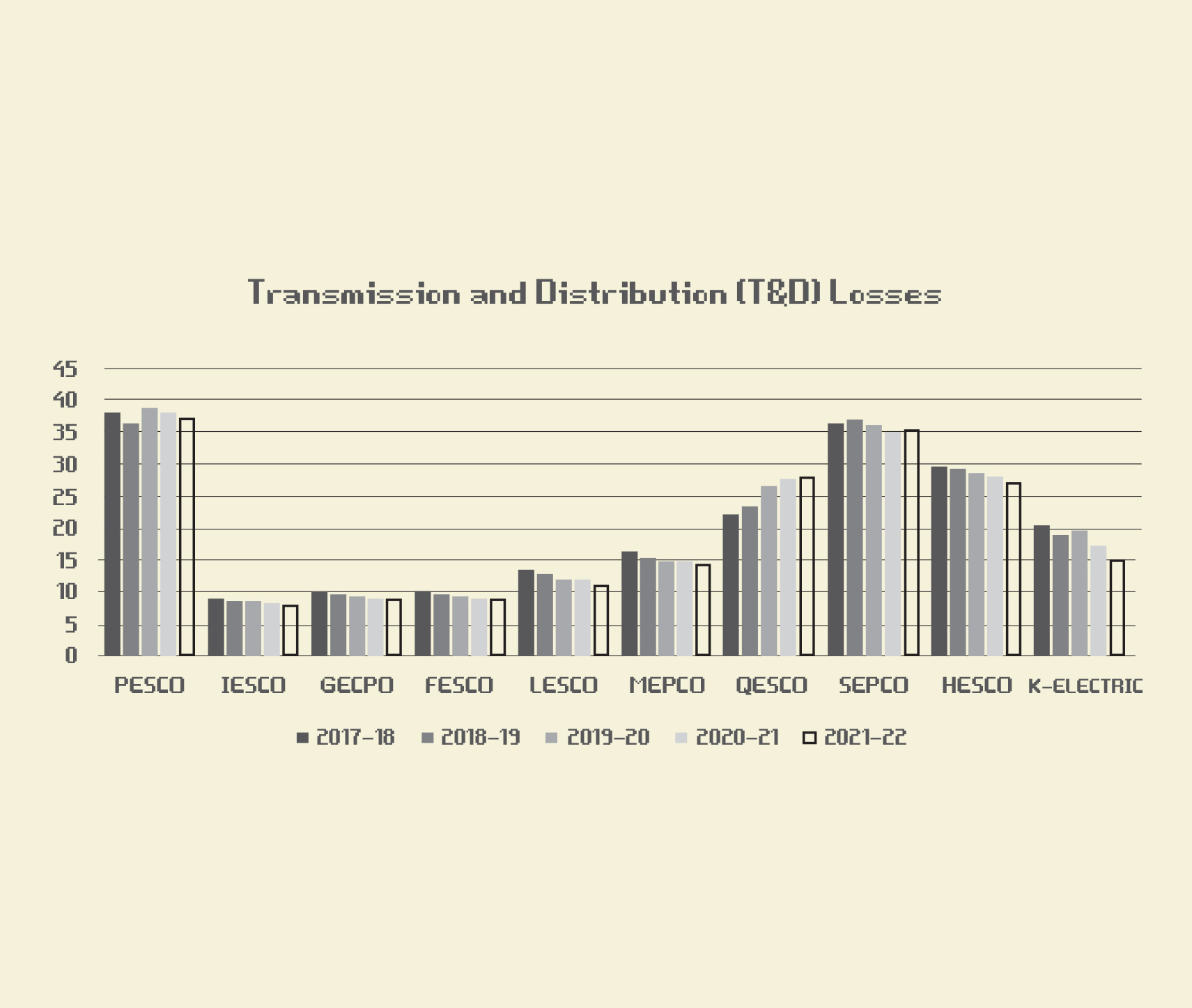

Losses of Discos

The losses of power distribution companies (discos) have been major concerns for the country that have contributed to higher electricity rates. These losses have been up to 40 percent for distribution companies. Earlier, the Nepra had allowed 12.5 percent losses to be recovered from the consumers. Later, it revised the benchmark and allowed power distribution companies to recover 15 percent losses from the power consumers. This also led to an increase in electricity rates.

Rather than tightening the noose around the power distribution companies to bring efficiency to reduce losses and power theft, it allowed power distribution companies to put an additional burden to the consumers. The low recovery of electricity bills has been also another reason that led to an increase in electricity rates. During the last 10 months, the recovery of electricity bills has been at 86 percent which was at the lowest level.

Revenue-based supply of electricity

The other factor is that government supplies more electricity to those areas where the people pay more bills. It means that it cuts electricity supplies to those areas where the electricity bill connection is lower. Power distribution companies also use this formula to reduce their losses. Whenever they feel that their losses going up, they suspend supplies to different areas to cut the losses.

Flooding of IPPs

All the former governments continued working on installing Independent Power Plants (IPPs) based on imported fuel without taking into account the future impacts. Now, during a recent public hearing, it was made shocking disclosure that country had 45,000 MW installed capacity but the generation was only 26,000 MW during peak time. So, the consumers were paying capacity payments for the remaining IPPs. It has also come to be known that consumers will end up paying 90 percent of capacity payments during the next few years due to more power projects in the pipeline.

Why govt can't control tariff increase

The major reasons were that the government could not overcome increase in electricity rates due to the pumping of new power plants. The capacity was going to increase but the country was still facing a shortage of electricity. The major reason was that the transmission and distribution system was not ready to transport electricity. Secondly, more power plants were going to be inducted into the system and there was a burden of capacity payments on the consumers.

There is a myth that there was a surplus of power during the Musharraf regime. The number of customers during Musharraf regime was not too high. With the passage of time, the number of customers increased and therefore, the usage of electricity also increased. Then Nepra had said that new plants were based on around 6 percent economic growth. So, the economic growth declined and therefore, the demand of electricity also declined. But consumers still need electricity. However, the revenue-based formula and expensive electricity had resulted in a shortage.

The previous governments also avoided providing full supply to the consumers which could also result in political backlash due to higher prices of electricity.

During the PML-N tenure, the power division had assured the then Prime Minister Nawaz Sharif that there would be no load shedding. But the country faced the worst load shedding in 2017 towards the end of the PML-N government's tenure. The major reason was a delay in new power plants. Nawaz Sharif was also assured that Neelum-Jhelum power plant would be online but that too was delayed.

Moreover, the PML-N government had paid Rs 480 billion to the IPPs, a case that landed in the National Accountability Bureau (NAB). The IPPs had assured to end load shedding by adding additional power to the national grid but they did not cooperate after receiving payment.

During Sharif's tenure, there were some other problems like electricity theft, losses, corruption in Discos and soaring circular debt that continued to plague the entire energy chain.

Design: Mohsin Alam

Design: Mohsin Alam

IMF and Electricity Rates

The International Monetary Fund (IMF) has always pressured the Government of Pakistan to reduce subsidies in the power sector. It wants the government to run the power distribution companies (discos) on a commercial basis. It is against adhocism in the power sector and therefore had demanded to make a full recovery of the cost of electricity from the power consumers. According to the IMF, the subsidies in the power sector were causing hurdles to running the entire energy chain. This is why the present government had to increase the base tariff by around Rs 5 per unit.

Not enough dollars to import fuel

Pakistan's power plants were all being run on imported fuel. The current government faced a default-like economic situation when it had no dollars due to a delay in the IMF deal. It also put LCs in all sectors, including power sectors, on hold due to a shortage of dollars. A major portion of dollars was smuggled to Afghanistan. So, the government did not have any dollars to import fuel which also resulted in a shortage of fuel such as LNG.

Even, Pakistan LNG Limited (PLL) was not able to import LNG due to higher prices in the global market and failure to arrange spot LNG cargoes.

Issues in the power sector

All the governments have been making political appointments of chief executive officers (CEOs) of power companies by setting aside the merit policy. The same is the case with the appointment of the board of directors of power companies. The objective of the board of directors is to formulate policies that bring efficiency and improvement in the companies. But they never worked to do so.

During the tenure of Pakistan Peoples Party (PPP) in 2010, Asia Development Bank (ADB) and the World Bank had asked Pakistan to give a target to the CEOs to cut losses. PPP had also warned the CEOs to cut losses or face removal from jobs. But all that also went in the dustbin and no strategic measures were taken.

Losses in the power sector

Power distribution companies like Hesco and Pesco face high losses of up to 40 percent. They have never been able to control losses. So, these losses continued rising and that led to an increase in circular debt. Moreover, the government enforces uniform tariffs across the country. This means that consumers of efficient power companies like Iesco were also paying to inefficient companies like Hesco and Pesco. This formula has also burdened consumers.

Short-term policies

Every government follows short-term policies to get rewards in terms of building its political image. The quickest option to do that is to build IPPs. Buildings large dams like Diamer Bhasha and Mohmand dams take time so they are neglected projects. Such policies have shifted the focus on thermal power plants while ignoring hydel and renewable energy. This is a major reason that contributed to a hike in electricity rates due to poor energy mix.

The way forward

The government should privatise the power sector which would help to bring efficiency and reduce corruption that had plagued the entire energy chain. The other option for the government is to hand over the companies to the provinces to run them. Thirdly, these companies should be split into small ones to put their house in order.

Comments

Post a Comment